flow through entity private equity

Investors such as sovereign wealth funds to own their indirect interests in certain types of fund investments through an entity taxable as a us. Some of the most active investors in private equity funds are governmental pension plans such as those for states or municipalities.

How To Find Private Money For Real Estate Investing Free Video Training Real Estate Investing Getting Into Real Estate Real Estate Tips

There is an exception to this definition.

. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. Blocker corporations are corporations in the. Blockers are typically used to block or prevent a group of investors from gaining control of a company.

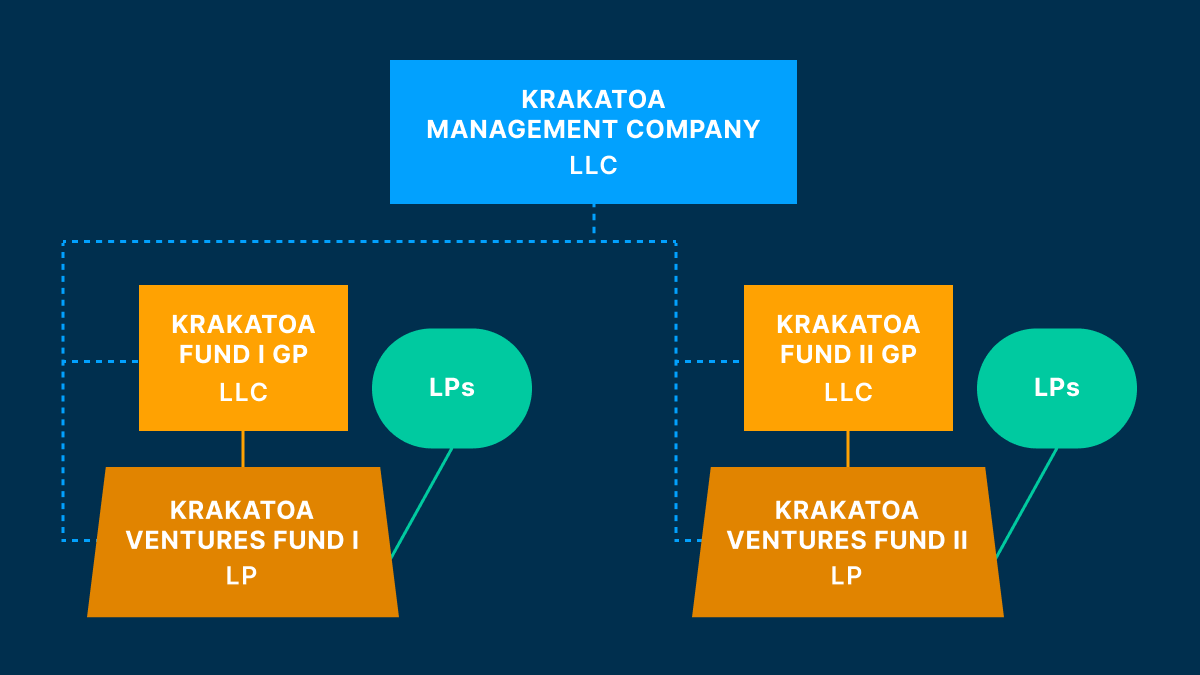

Blockers can be used in a variety of different situations but are most commonly used in situations where a group of investors is trying to take control of a company through a hostile takeover. How a Democrat-controlled US government could impact private equity. A private equity or hedge fund located in the United States will typically be structured as a limited partnership due to the lack of an entity-level tax on partnerships and other flow-through entities under the US.

Business ie a portfolio company organized as a partnership or LLC certain tax-sensitive fund LPs virtually all non-US. Most of the income of most private equity and venture capital funds will consist of gains from the sale of portfolio. Most governmental plans take the position that as governmental entities.

Flow-Through Withholding FTW registration does not constitute a valid election into FTE nor. Need to invest through a parallel fund that excludes tainted income or have the right to opt-out of certain investments if the government investor is a controlled entity. LPs and many US.

An entity is considered a flow-through entity if it is treated as tax transparent in the jurisdiction it was created which we understand to mean the jurisdiction under the laws of which it is constituted. It is typical in private equity funds for certain tax-sensitive investors including us. Investor generally will not.

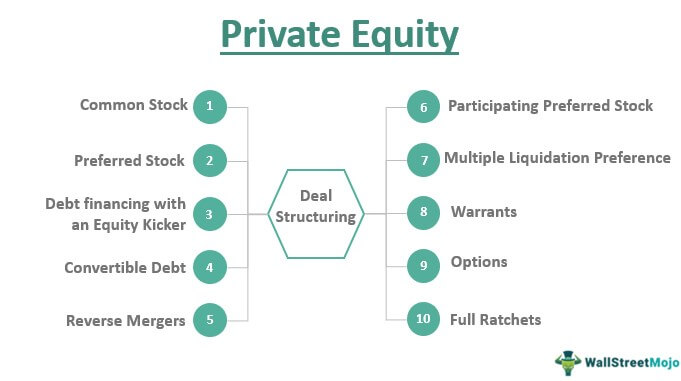

Planning devices can include the following. If the entity is treated as opaque in. In addition the non-US.

Private equity investors growing acceptance of flow-through entities means more work for the finance team delegates learned at pfms inaugural tax forum. Where a private equity fund invests in a flow-through portfolio company engaged in a US. The limited partners will be the institutional and individual investors.

The model rules refer to flow-through entities. Tax exempts and non-us. 1 Perhaps the biggest advantage for investors is that they are exposed to limited liability.

LP defaults force majeure and over-collateralization amid covid-19. The advantages of these structures for a private equity fund are as follows. States real property interests USRPIs or interests in flow-through entities themselves engaged in a US.

Corporation a so-called blocker which insulates such investors from the direct. Tax-exempt LPs typically elect to hold their share of such fund investment through a blocker corpora - tion. A private equity fund or other investor in purchasing a corporation may wish to establish an LLC or other pass-through entity as a holding vehicle permitting flexible economics a control vehicle and the ability to grant profits interests as a compensation incentive discussed below.

Fees and expenses survey 2018. If anything goes wrong in the investment process bankruptcy lawsuits etc the investor risks only the capital they have committed. Trade or business flow-through operating entities.

Fees Expenses Survey 2020. However the late filing of 2021 FTE returns will be accepted as timely if filed within 6 months of the due date. Which private asset classes are experiencing a boom in dealflow.

Private equity investors growing acceptance of flow-through entities means more work for the finance team delegates learned at pfms inaugural tax forum. Basic US Tax Regime Applicable to Non-US Investors The basic US tax regime applicable to non-US investors in US-based private equity funds is. Private Funds CFO 2019 Yearbook.

Indebtedness and cannot invest in flow-through operating entities except through blocker structures as discussed below.

Stock Talk New Brand Names For The New Decade 2020 30 Movie Market Brand Names Jet Airways

Joint Venture Financial Strategies Finance Key Success Factors

Aqa As Business Understanding Different Business Forms Website Teaching Business Study Notes Aqa

Private Equity Fund Structure A Simple Model

Register Your One Person Company Registration In Kolkata Sole Proprietorship Public Limited Company Company

Private Equity Meaning Investments Structure Explanation

Compliances For Private Limited Company Llp And Opc A Clear Comparison

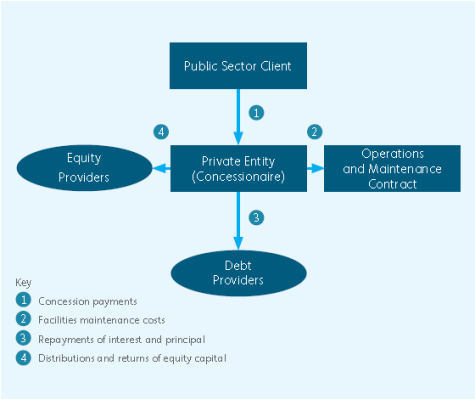

What Are Public Private Partnerships

How To Invest In U S Real Estate From Another Country What You Need To Know Investing Small Flags Real Estate

Evaluating New Projects With Weighted Average Cost Of Capital Wacc Cost Of Capital Weighted Average Accounting And Finance

Leveraged Recapitalization Meaning Pros Cons And More In 2022 Corporate Strategy Financial Management Meant To Be

Brave Uncovers Google S Gdpr Workaround Brave Browser Online Habits Brave Browser Brave

The Legal Structures Of Venture Capital Funds Carta

What Is A Private Equity Waterfall The Preferred Method Of Equity Funding

How Private Equity Firms Raise Money Private Equity How To Raise Money Equity

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning Attorney

Private Equity Fund Structure A Simple Model

How To Get Approved By Private Label M A P And Exclusive Dropshipping Suppliers Keep In Mind Trust Yourself Dropshipping Suppliers Internet Marketing